student loan debt relief tax credit 2020

Should I Apply for a New Credit Card During COVID. Close 866 612-9971 866 612-9971.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

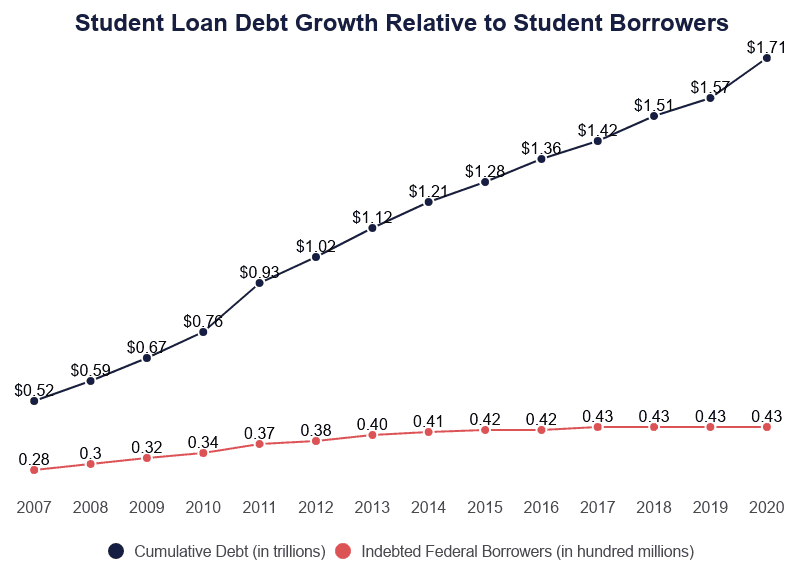

The average student is also taking on more debt.

. About 60 of Asian bachelors degree holders have educational loan debt. The original coronavirus relief bill known as the CARES Act and signed into law on March 27 2020 helped most federal student loan borrowers by temporarily pausing payments and involuntary. Examples include the earned income tax credit EITC child tax credit and the American Opportunity Tax Credit.

2020 Guide to 401k Matching for Student Loan Debt Payments. What lenders are doing to help. President Joe Biden on Wednesday announced that he will cancel up to 20000 of student loan debt held by the US.

The Student Loan Repayment Benefit is the name and it is being offered by employers who contribute a certain dollar amount per year toward paying off an employees student loans. If you notice something out of place voice your concern as soon as possible and ask questions if youre unsure about what you. Debt consolidation is a method for simplifying your monthly payments and altering your loan terms through a bank loan or debt.

Largely depends on how you manage your debt. On its co-signed credit-based student loan for undergraduates. RISLA was a winner of Forbes Advisors best private student loans of 2020 awards.

People within the same eligibility criteria who received a Pell. May be to closely monitor your credit report and your student loan repayment process for errors. Students who graduated from UK.

A financial or credit institution or an insurance company that is subject to examination and supervision by an agency of the US or any State. Companies offer the perk but 8 of companies with 40000 employees or more have it. If the qualified hire works at least 400 hours employers can claim 40 of the first 6000 in wages.

So far only 4 of US. If you individually earned less than 125000 per year in the 2020 or 2021 tax year or 250000 for married couples up to 10000 of student loan debt will be forgiven. Refundable credits are paid out in full no matter what your income or tax liability.

Practical Suggestion for Tax Refund. Coronavirus student loan payment and debt relief. Practical Suggestion for Tax Refund.

About 40 of Black graduates have student loan debt from graduate school while 22 of white college graduates have graduate school debt. That gives them a maximum income tax credit of 1500. UPDATED Tuesday March 24th 2020.

If youre looking for student loan debt relief the answer might be. If you dont want to pursue a BDAR. Which of these tax credits apply to your situation.

Several student loan exceptions. Thatd be a potential tax credit of 2400. Close 866 612-9971 866 612-9971.

File a Free Application for Federal Student Aid FAFSA link FAFSA changes story. How to Qualify for the ITT Tech Lawsuit Student Loan Forgiveness Program. Department of Education for borrowers who make less than 125000 per year or.

Close 866 612-9971 866 612-9971. 2020 Guide to Federal Student Loan Debt Relief Programs. Federal student loan servicers.

What to Know About Student Loan Debt Relief Many will benefit. Student Loan Repayment Plans. Nationwide the average federal student loan debt balance is 37667 an amount that 83 of non-homeowners say is preventing them from buying a home according to the National Association of Realtors.

If you attended ITT Tech between 2006 and 2016 then you may qualify for ITT Tech student loan forgiveness benefits via either the The Borrowers Defense To Repayment program or the Closed School Loan Discharge program. Today calls for relief were answered when President Joe Biden announced that his administration would be canceling up to 10000 in student loans for those with federal debt and up to 20000. The Consolidated Appropriations Act passed in December 2020 as pandemic relief extends tax exclusion of discharged mortgage debt through 2025 with a maximum of 750000.

As we enter tax season borrowers should keep in mind that in some cases student loan forgiveness may be taxable. Practical Suggestion for Tax Refund. On March 27 2020 the Coronavirus Aid Relief and Economic Security Act which is meant to provide emergency public health and economic assistance was signed into law.

The departments plan contemplates that all types of federal student loans would be eligible for loan forgiveness including Grad and Parent PLUS loans as well as federal loans owned by private. 2020 Guide to Student Loan Interest Tax Deductions. Pay off Credit Card Debt.

Students are generally borrowing more. News and World Report. In other cases it may not.

The balance per borrower rose by 26 percent from 2009 to 2020 according to US. Pay off Credit Card Debt. Pay off Credit Card Debt.

Universities in 2020 owed an average of 45000 in student loan debt. By the end of March 2021 the estimated value of. The skyrocketing cumulative federal student loan debt16 trillion and rising for more than 45 million borrowersis a significant burden on Americas middle class.

There is a Short-term Unemployment credit. Student Loan Consolidation. President Bidens executive order means the federal student loan balances of millions of people could fall by as much as 20000.

And in 2022 the issue is more complicated than ever. A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees such as tuition books and supplies and living expensesIt may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. Trim your bill by up to 2000 for each qualifying minor child in your household.

If they work at least 120 hours employers can claim 25 of the first-year wages paid up to 6000. How the New FICO Credit Scoring System Will Affect You January 29. The fact that 73 of 2017 college graduates had student loan debt shows that is difficult but there are some steps you can take to minimize if not eliminate loans.

2020 Guide to.

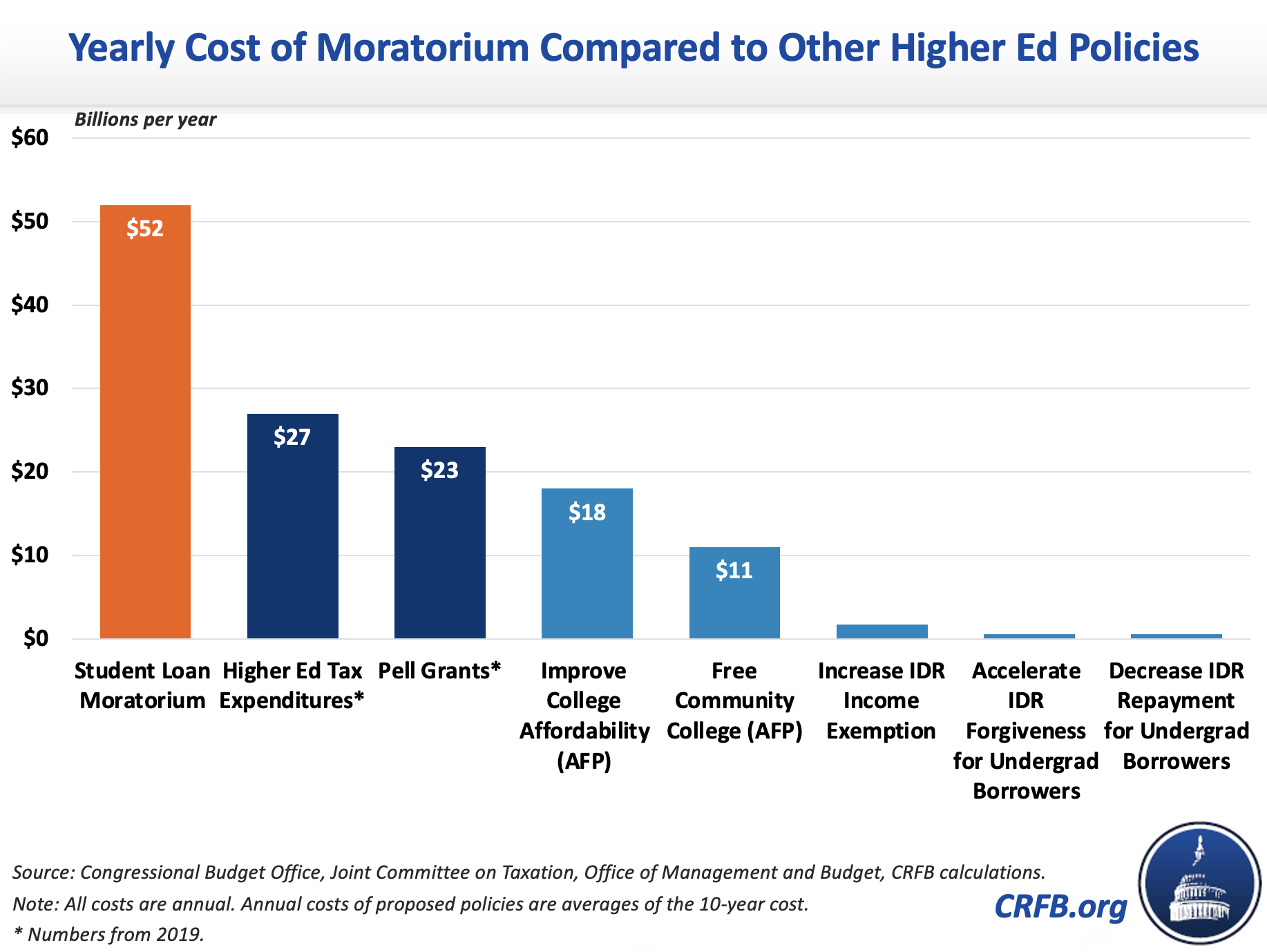

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Covid 19 Relief Bill Passes With Tax Free Status For Student Loan Forgiveness

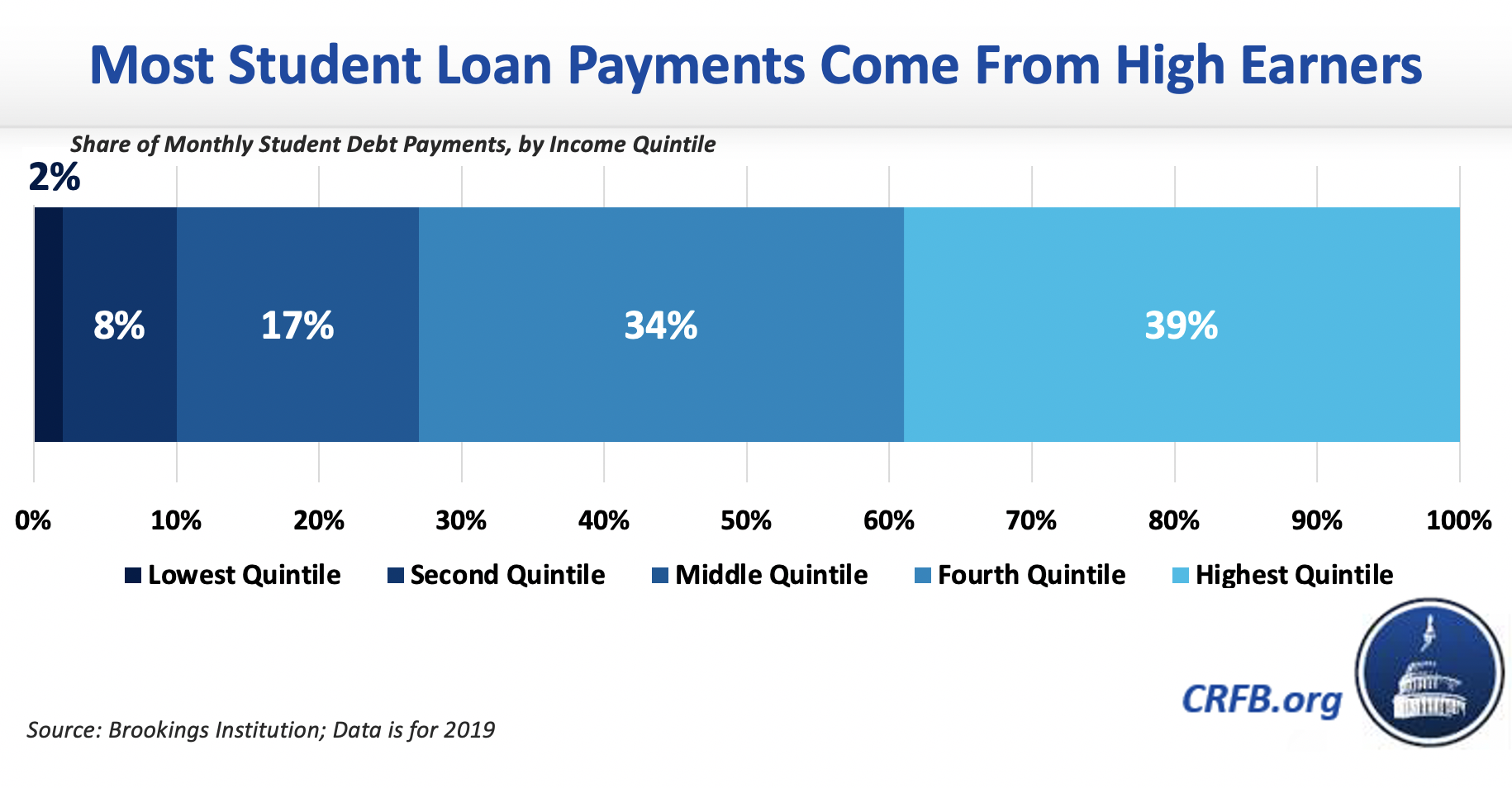

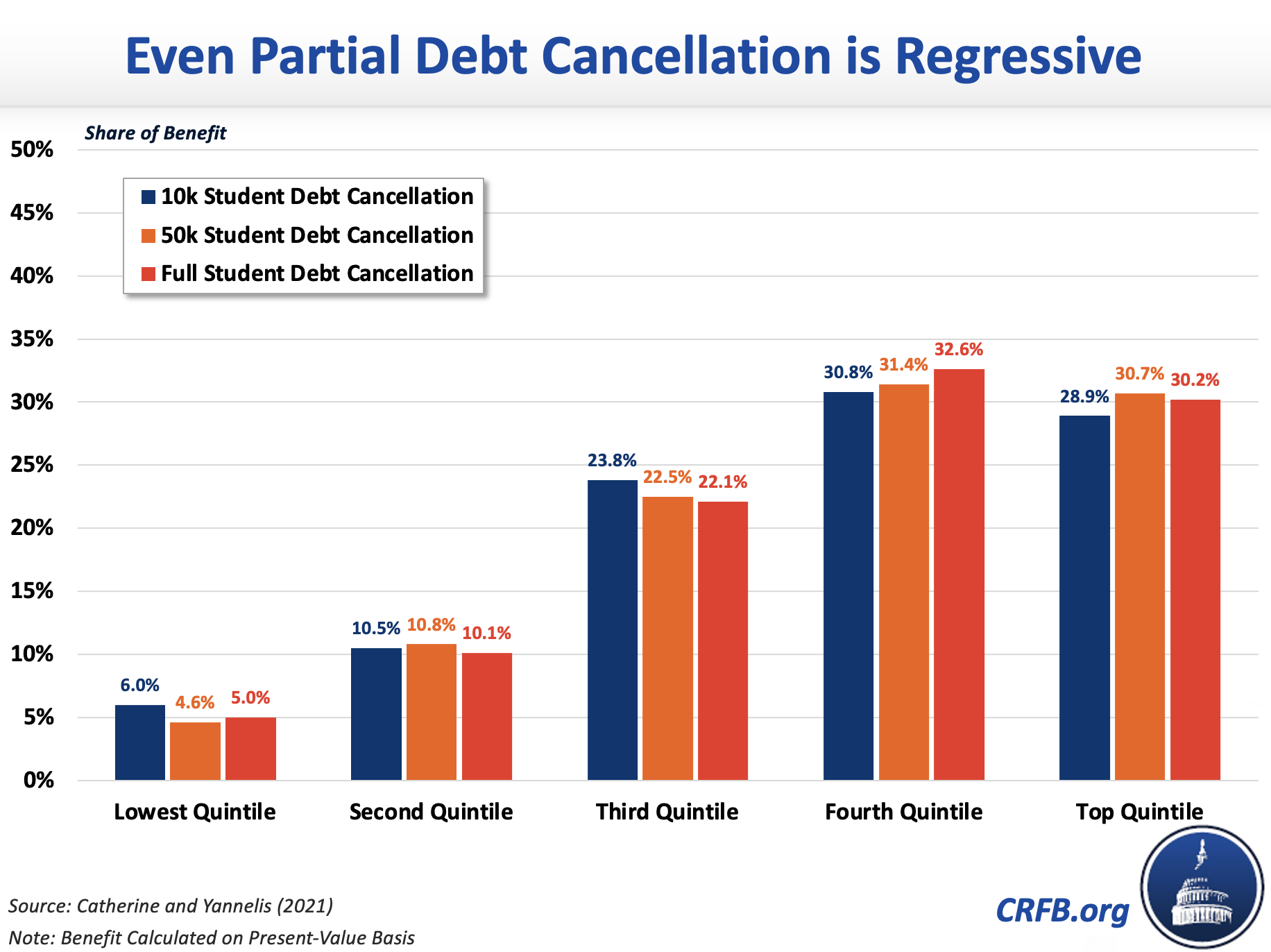

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Student Loan Forgiveness Statistics 2022 Pslf Data

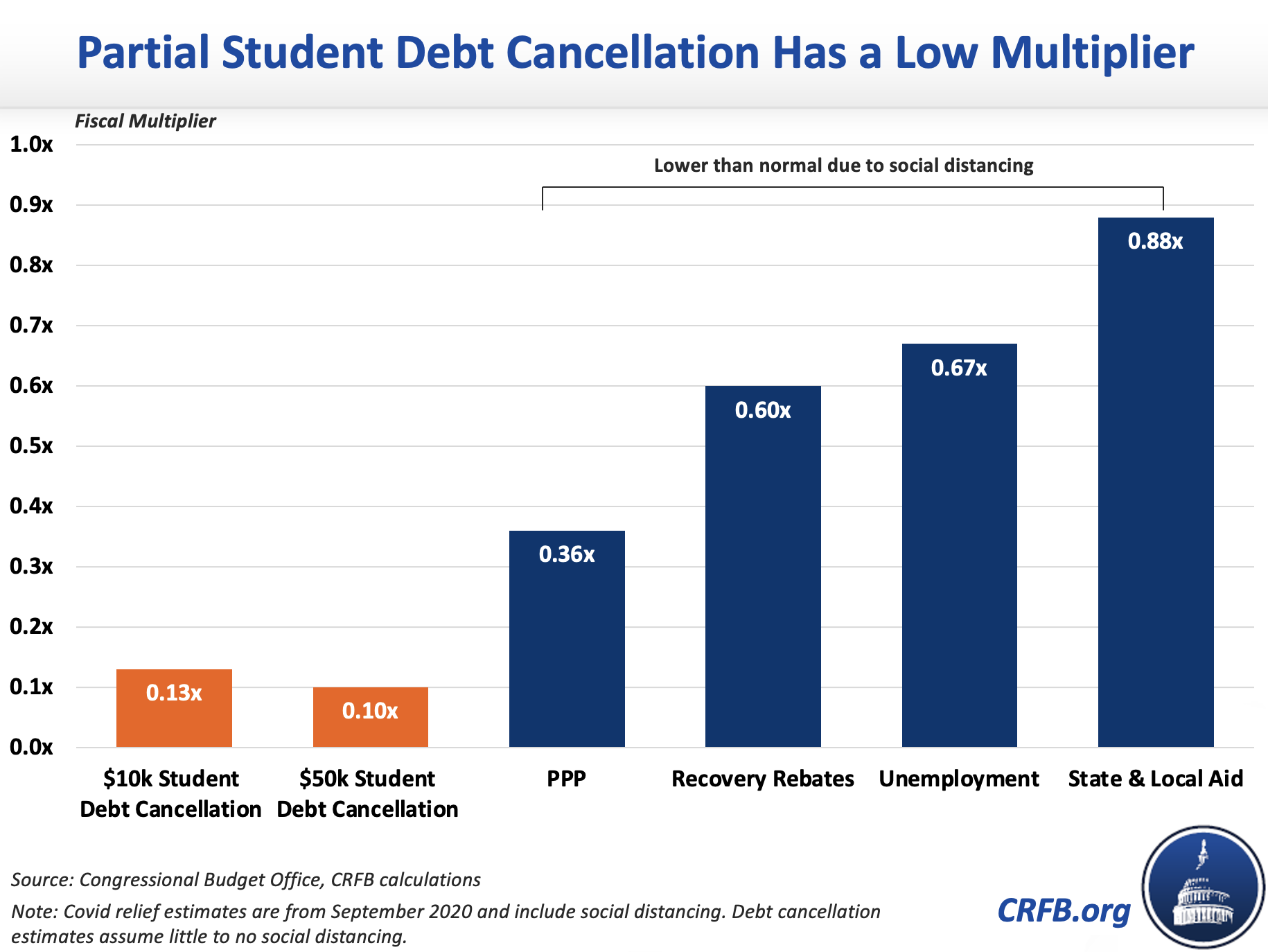

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Can I Get A Student Loan Tax Deduction The Turbotax Blog

What Is The Current Student Debt Situation People S Policy Project

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Student Loans The Racial Wealth Divide And Why We Need Full Student Debt Cancellation

Is Taking On More Student Debt Bad For Students Econofact

Chart Americans Owe 1 75 Trillion In Student Debt Statista

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Student Loan Debt Crisis In America By The Numbers Educationdata Org

Who Owes The Most Student Loan Debt

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero